Planning for retirement can feel overwhelming. How much do you need? Are you saving enough? A retirement calculator transforms these abstract questions into concrete numbers and actionable plans.

What a Retirement Calculator Shows

Instead of guessing, a calculator gives you a clear projection of your future. It reveals your future savings balance, estimating the monthly income that pot will generate. Crucially, it highlights any savings gap if you're falling behind and demonstrates how even small increases in contributions—or capturing your full employer match—can dramatically change your trajectory.

The Power of Starting Early

Example: The Cost of Waiting

Let's compare two friends who invest with the same monthly contribution of $500 and a 7% annual return.

| Sarah (Starts at 25) | Mike (Starts at 35) | |

|---|---|---|

| Years Investing | 40 Years | 30 Years |

| Total Contributed | $240,000 | $180,000 |

| Balance at 65 | $1,330,000 | $610,000 |

The Result: Sarah ends up with $720,000 more than Mike, even though she only contributed $60,000 more of her own money. This is the exponential power of compound interest—your money makes money on itself.

Real Calculator Example

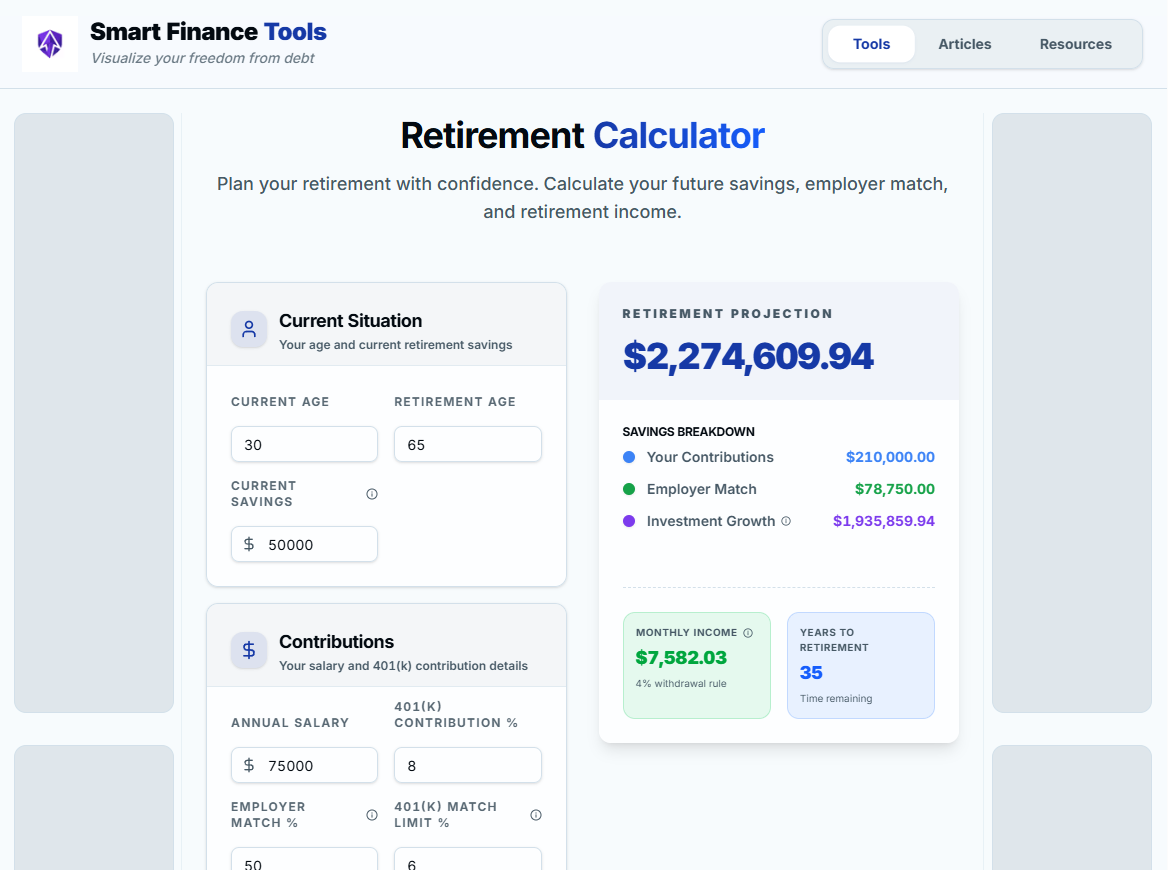

Here's what a 35-year retirement plan looks like in our calculator for a 30-year-old:

Scenario:

You start at age 30 with $50,000 saved and a $75,000 salary. You contribute 8% ($500/month), and your employer matches 3% ($188/month).

The Breakdown:

- Your Contributions: $210,000

- Employer Match: $78,750

- Investment Growth: $1,935,860

Notice that investment growth accounts for the vast majority of the final $2.27 Million total. This confirms that time in the market is more important than timing the market.

How Much Do You Need to Retire?

The 4% Rule

A common rule of thumb is to withdraw 4% of your retirement savings annually. Historically, this rate allows your portfolio to last 30+ years without running dry.

If you want $60,000/year in retirement income, you need: $60,000 ÷ 0.04 = $1,500,000

The 25x Rule

Alternatively, aim to save 25 times your desired annual income.

- Want $80,000/year? Need $2,000,000.

Don't Forget Social Security

In 2026, the average Social Security benefit is ~$1,900/month ($22,800/year). You only need to fund the gap between your desired income and this benefit.

Target your goal to $60,000/year. Social Security covers $22,800. You need to fund $37,200. Target Nest Egg: $37,200 × 25 = $930,000

Understanding Employer Match

Your employer match is essentially part of your salary—don't reject a raise!

| Match Formula | How It Works |

|---|---|

| Dollar-for-Dollar | Employer adds $1 for every $1 you contribute (usually up to a % limit). |

| 50 Cents per Dollar | Employer adds $0.50 for every $1 you contribute. |

The Cost of "Free" Money:

If you earn $75,000 and skip a 6% dollar-for-dollar match, you lose $4,500/year. Over a 30-year career, that mistake could cost you over $227,000 in lost growth.

Contribution Strategies

- Start with Employer Match: Your #1 priority is contributing enough to capture the full match. It's an instant 50-100% return on your investment.

- Increase 1% Annually: Features like "auto-escalation" increase your contribution by 1% each year. You likely won't feel the difference in your paycheck, but a shift from 6% to 15% contributions can double your retirement outcome.

- Max Out Tax Levels: In 2026, leverage limits for 401(k)s ($23,000), IRAs ($7,000), and HSAs ($4,150) to lower your taxable income today while building wealth for tomorrow.

Investment Return Assumptions

When projecting growth, choose an assumption that matches your risk tolerance and portfolio mix.

| Strategy | Return | Composition |

|---|---|---|

| Conservative | 5% | Mostly bonds; lower risk, lower growth. |

| Moderate | 7% | Balanced mix; historical average for long-term investors. |

| Aggressive | 9% | Mostly stocks; higher volatility but higher potential. |

An aggressive portfolio ($918k) can end up with more than double a conservative one ($416k) over 30 years.

Retirement Savings Milestones by Age

Benchmarks help you track your progress relative to your salary (e.g., $75,000).

| Age | Target Multiplier | Example Savings |

|---|---|---|

| 30 | 1x Salary | $75,000 |

| 40 | 3x Salary | $225,000 |

| 50 | 6x Salary | $450,000 |

| 60 | 8x Salary | $600,000 |

| 67 | 10x Salary | $750,000 |

Common Retirement Mistakes

- Not Starting Early Enough: Delaying creates a gap that is expensive to close later.

- Cashing Out Early: Taking $30,000 out at age 35 costs you ~$228,000 in lost future value, plus immediate taxes and penalties.

- Ignoring Fees: High expense ratios erode wealth. A 1% fee difference can cost you over $100,000 over 20 years.

Take Action

Use our Retirement Calculator to:

- Project your savings based on your current habits.

- Calculate match benefits to ensure you aren't leaving money on the table.

- Test scenarios to see how a small 1-2% increase impacts your future freedom.

The best time to start saving was yesterday. The second best time is today.

Plan your retirement with our Retirement Calculator