If you're carrying debt—whether it's a car loan, student loan, or personal loan—you're likely paying more in interest than you realize. The good news? A loan payoff calculator can help you visualize exactly how much you could save by making strategic extra payments.

What Is a Loan Payoff Calculator?

A loan payoff calculator is a financial tool that shows you how different payment strategies affect your loan timeline and total interest paid. By inputting your loan details and experimenting with extra payment scenarios, you can see the real impact of paying more than your minimum monthly payment.

Key Information You'll Need

Before using a loan payoff calculator, gather these essential details about your loan:

| Information Needed | What It Means |

|---|---|

| Current Loan Balance | How much you still owe |

| Interest Rate (APR) | Your annual percentage rate |

| Monthly Payment | Your required minimum payment |

| Loan Term | How many months remain on your loan |

Understanding Your Loan Amortization

When you make a loan payment, it's split between principal (the actual loan amount) and interest. Early in your loan term, most of your payment goes toward interest. As time goes on, more goes toward principal.

This is called amortization, and it's why extra payments early in your loan term have such a powerful effect.

Example: $20,000 Auto Loan

Loan Details: $20,000 at 6% APR | 60-month term | $386.66 monthly payment

| Payment Strategy | Total Interest | Payoff Time | Savings |

|---|---|---|---|

| Standard Payment | $3,199.68 | 60 months | - |

| +$100 Extra/Month | $2,235.09 | 44 months | $964.59 and 16 months |

How to Use Our Loan Payoff Calculator

Step 1: Enter Your Loan Details

Start by inputting your current loan information. Be as accurate as possible—even small differences in interest rates can significantly impact your results.

Step 2: Explore Extra Payment Options

Our calculator offers three types of extra payments:

| Payment Type | Description | Best For |

|---|---|---|

| Monthly Extra | Add a fixed amount to each payment | Consistent budgeting and steady progress |

| Yearly Extra | Make one large payment annually | Tax refunds, bonuses, or strategic timing |

| One-Time Extra | Apply windfalls directly to principal | Inheritance, bonuses, or unexpected income |

Step 3: Set a Payoff Goal

Want to be debt-free by a specific date? Use the goal calculator feature to see exactly how much extra you need to pay each month to hit your target.

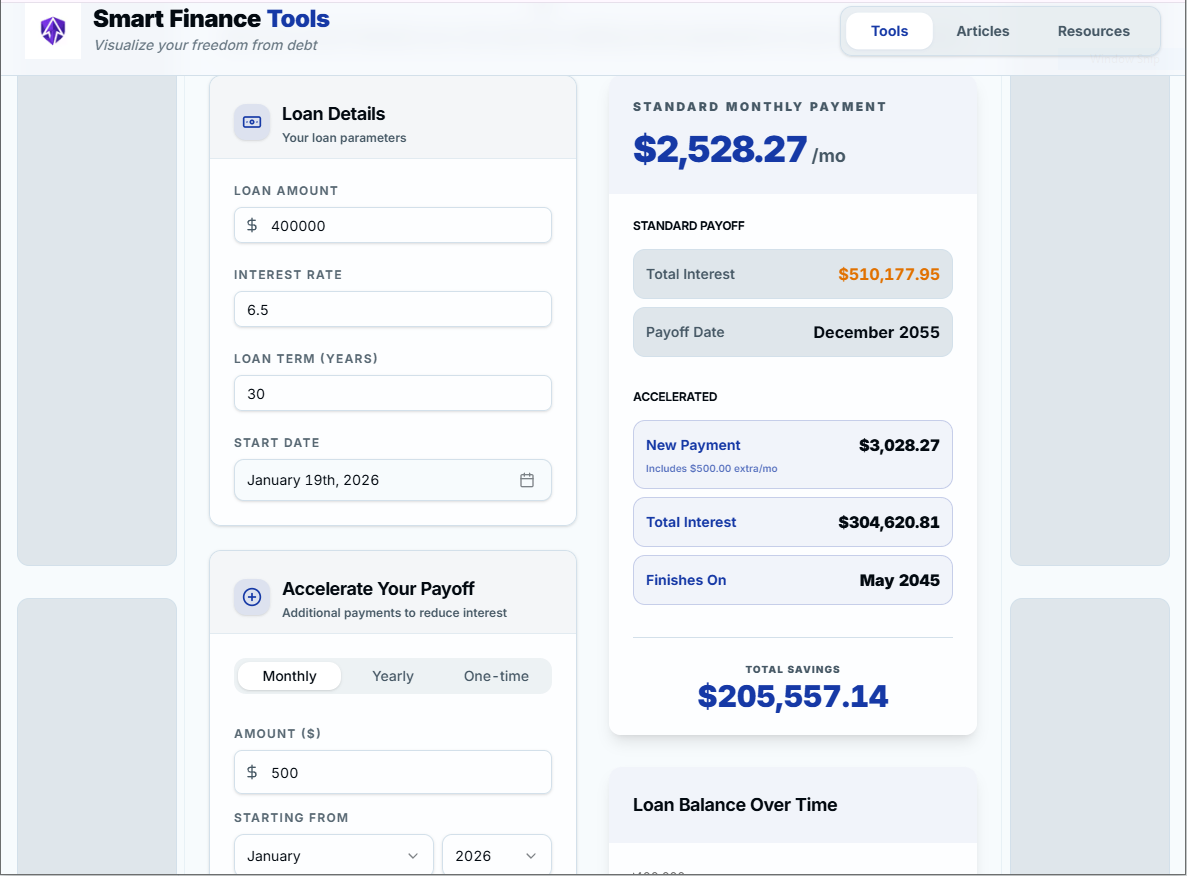

Real Example: $400,000 Mortgage Payoff

Here's a powerful real-world example using our calculator. With a $400,000 mortgage at 6.5% interest over 30 years, adding just $500 extra per month creates massive savings:

The results speak for themselves:

- Standard payoff: December 2055 (30 years)

- Accelerated payoff: May 2045 (10.5 years early!)

- Total interest saved: $205,557.14

- Monthly payment: $3,027 (vs. $2,527 standard)

This visualization shows exactly why extra payments are so powerful—you're not just saving money, you're buying back years of your life from debt.

Smart Strategies for Accelerated Payoff

The Bi-Weekly Payment Method

Instead of making one monthly payment, split it in half and pay every two weeks. You'll make 26 half-payments per year (equivalent to 13 full payments instead of 12).

Monthly payment: $386.66 → Biweekly payment: $193.33

Extra payment per year: $386.66

Time saved: ~4 months

Interest saved: ~$400

The Round-Up Strategy

Round your payment up to the nearest $50 or $100. It's psychologically easier and creates automatic extra payments.

Required payment: $386.66 → Round up to: $400

Extra per month: $13.34

Annual extra: $160.08

The Windfall Acceleration

Apply unexpected money directly to your loan principal, such as tax refunds, work bonuses, cash gifts, or side hustle income.

Common Mistakes to Avoid

1. Not Specifying "Principal Only"

When making extra payments, always specify that the extra amount should go toward principal. Otherwise, lenders might apply it to future interest or hold it in suspense.

2. Ignoring Prepayment Penalties

Some loans charge fees for early payoff. Check your loan agreement before implementing an aggressive payoff strategy.

3. Neglecting Higher-Interest Debt

If you have multiple debts, prioritize the one with the highest interest rate first (debt avalanche method) for maximum savings.

4. Sacrificing Emergency Savings

Don't deplete your emergency fund to pay off low-interest debt. Maintain at least 3-6 months of expenses in savings.

Real-World Success Story

Sarah had $35,000 in student loans at 5.5% APR with a 10-year term and $381 minimum payment.

Her strategy: Added $200/month extra + $2,000 annual tax refund + one-time $500 from side hustle

Results: Paid off in 5 years (not 10)

Saved $5,847 in interest

Freed up $381/month for investing

Take Action Today

Ready to see how much you could save? Use our Loan Payoff Calculator to:

- Calculate your current payoff timeline

- Experiment with different extra payment amounts

- Set a realistic payoff goal

- Generate a custom payment schedule

Remember: Every extra dollar you pay toward principal is a dollar that won't accrue interest. Start small, stay consistent, and watch your debt disappear faster than you thought possible.

Use our Loan Payoff Calculator to create your personalized debt elimination strategy today.