Buying a home is the largest financial decision most people make. A mortgage calculator helps you understand exactly what you can afford and how different loan options affect your monthly budget and long-term costs.

What a Mortgage Calculator Shows You

| Feature | What It Shows |

|---|---|

| Monthly Payment (PITI) | Principal, Interest, Taxes, Insurance |

| Total Interest Paid | The extra cost of borrowing |

| Amortization Schedule | Payment breakdown over time |

| Break-Even Analysis | When you build enough equity |

The Four Components of Your Monthly Payment

1. Principal

The actual loan amount you're paying down. Early in your mortgage, very little goes toward principal.

2. Interest

The cost of borrowing. In the first years of a 30-year mortgage, 70-80% of your payment is interest.

3. Property Taxes

Annual taxes divided monthly. Varies by location from 0.3% to 2.5% of home value.

4. Homeowners Insurance

Required by lenders. Costs vary based on home value and location.

Plus PMI: Private Mortgage Insurance required with less than 20% down, typically 0.5-1% of loan amount annually.

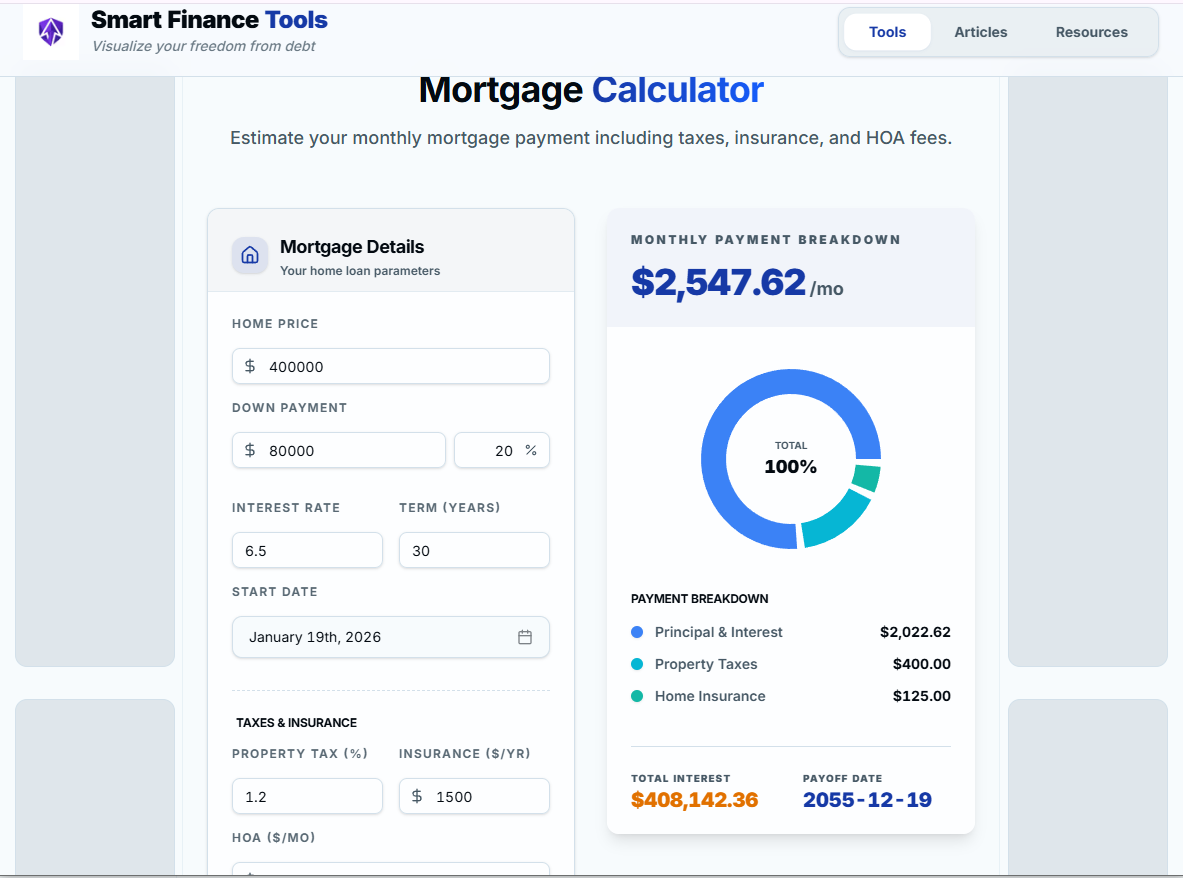

Home price: $400,000

Down payment: $80,000 (20%)

Loan: $320,000 at 6.5% for 30 years

Property taxes: $6,000/year

Insurance: $1,500/year

Monthly Payment: P&I: $2,023 + Taxes: $500 + Insurance: $125 = $2,648/month

Over 30 Years: Total paid: $953,280 | Total interest: $408,280

See It In Action

Here's what this looks like in our mortgage calculator:

The calculator breaks down exactly where your money goes each month and shows the total cost over the life of the loan. Notice how the total interest ($408,142) is more than the original loan amount—this is why understanding your mortgage is so important!

15-Year vs. 30-Year Mortgage

| Term | Rate | Monthly P&I | Total Interest | Notes |

|---|---|---|---|---|

| 30-Year | 6.5% | $2,023 | $408,280 | Lower payments, more flexibility |

| 15-Year | 5.75% | $2,656 | $158,080 | Save $250,200! Faster equity |

How Interest Rates Impact Payments

$320,000 Loan, 30-Year Term:

| Rate | Monthly P&I | Total Interest |

|---|---|---|

| 5.5% | $1,817 | $334,120 |

| 6.0% | $1,919 | $370,840 |

| 6.5% | $2,023 | $408,280 |

| 7.0% | $2,129 | $446,440 |

A 1.5% rate difference costs over $112,000!

Down Payment Strategies

| Down Payment | Benefits | Trade-offs |

|---|---|---|

| 20% Down | No PMI, better rates, lower monthly payments, more equity | Requires significant upfront cash |

| Low Down (3-5%) | FHA: 3.5%, Conventional: 3-5%, VA: 0% (veterans) | PMI required, higher rates, larger loan |

Using the Calculator Effectively

Step 1: Know Your Budget

Use the 28/36 rule:

- Housing ≤ 28% of gross income

- Total debt ≤ 36% of gross income

Step 2: Input Accurate Numbers

- Get current rates for your credit tier

- Research property taxes in target area

- Get insurance quotes

Step 3: Compare Scenarios

- Maximum affordability (lowest down, 30-year)

- Optimal value (20% down, 15-year)

- Balanced approach (10-15% down, 30-year with extra payments)

Extra Payment Strategies

Adding $200/month to a $320,000, 30-year loan at 6.5%

Payoff in 23 years (7 years sooner)

Interest saved: $108,000

When to Refinance

Consider refinancing when rates drop 0.75-1% below your current rate, your credit score improves significantly, you want to switch from 30 to 15-year term, or you can eliminate PMI.

Common Mistakes

- Focusing only on monthly payment - Ignore total interest cost

- Not comparing 15-year options - Miss massive savings

- Skipping rate shopping - 0.25% difference = $20,000 over 30 years

- Maxing out budget - Leave room for maintenance and lifestyle

Calculate Your Mortgage

Use our Mortgage Calculator to:

- Calculate exact monthly payments

- Compare 15 vs. 30-year options

- See impact of different down payments

- Understand total interest costs

- Plan extra payment savings

Start planning your home purchase with our Mortgage Calculator